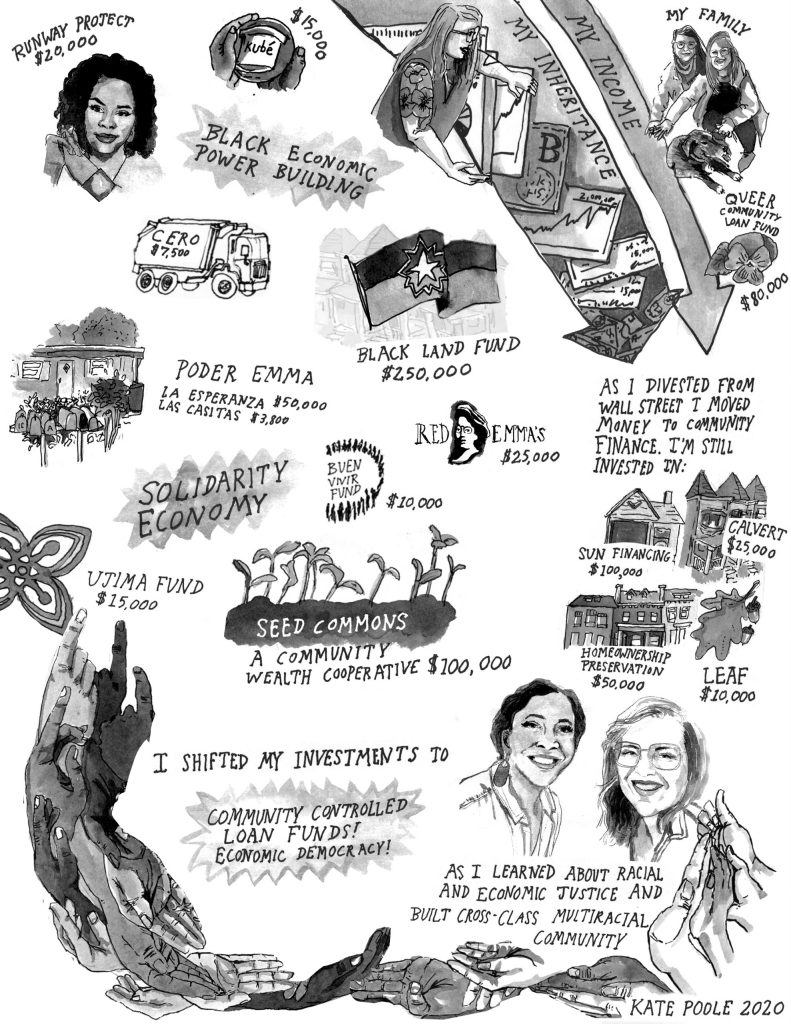

We believe the most strategic role for wealthy investors in transforming our economy is divesting from Wall Street and shifting their money into community-controlled investments that center racial and economic justice.

We invest in democratically-controlled loan funds and emergent solidarity economy investments that are higher risk and require a longer term investment.

As your investment advisors, we will transition your investment portfolio out of Wall Street and put it to work for racial and economic justice.

We’ll partner with you with a spirit of joy, shared risk, love, and a fierce desire for collective liberation.

We work with individuals who:

- Are ready to shift over $5 million to community investments in racial and economic justice, and are not dependent on market rate returns to support their expenses

- Are committed to wealth redistribution rather than wealth accumulation

- Want to shift their money from Wall Street into direct investments that build economic power in Black, indigenous, and other historically oppressed communities

- Are excited about investing in emergent solidarity economy projects that are higher risk and require a longer term commitment

Our investment advising offering includes:

- Supporting you to identify your core values which will be the foundation for your giving and investing

- Decoding your existing investments in order to develop a strategy to bring your investment portfolio into alignment with your values

- Portfolio management, and shifting your investments! In a seasonal rhythm, we will work with you to invest in community-controlled loan funds and the Solidarity Economy

- Seasonal conversations about your giving and investing, as well as redefining common financial terms like risk and return.

- Regular reports from us on your investment portfolio.

- Opportunities to be included in virtual Solidarity Salons and integrated capital webinars

- Joining the Chordata Community, and investing together in solidarity economy investments to help grow an economy that works for everyone

Our investment advising minimum is $5 million, and our rates begin at a $50,000 annual retainer.

In 2020 Kate made this comic for “Reckoning with Wealth,” an article featuring Chordata’s work in Princeton Alumni Weekly.