Chordata Capital is an anticapitalist wealth management firm with a commitment to support clients in redistributing rather than continuing to accumulate wealth.

We started Chordata with a vision that investors can enact wealth redistribution in practical and visionary ways, guided by an ethic of repair and a dream for a just economy.

What makes this work unique?

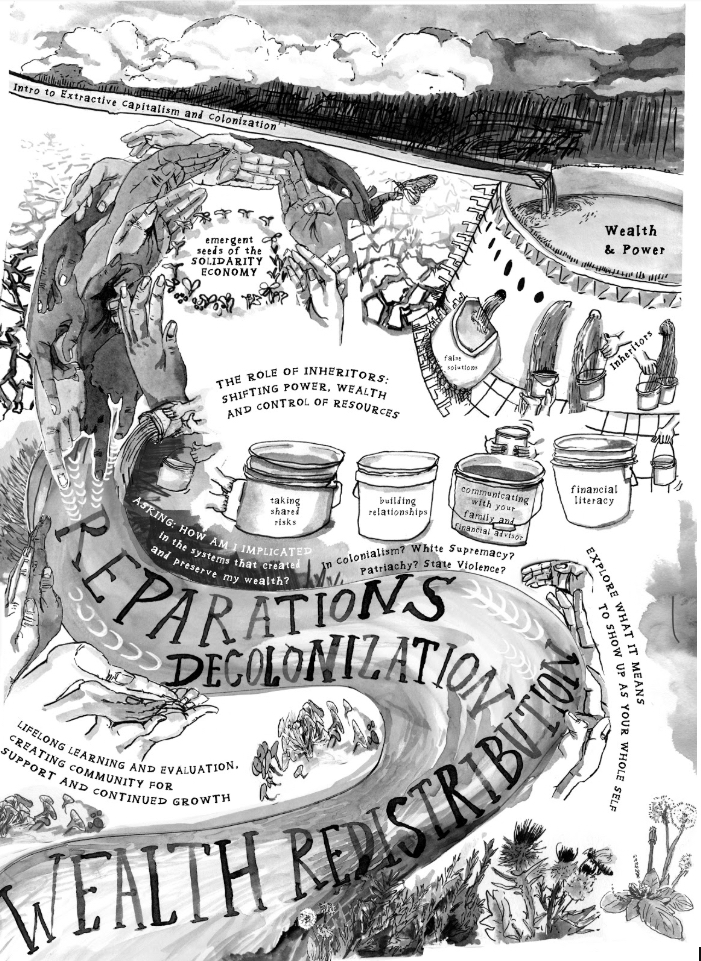

From the beginning, we have been clear that our work is to dismantle the extractive economy, to support wealth redistribution, and to work for racial justice. There are many alternatives to capitalism. Chordata’s work is to support and invest in radical experiments building Solidarity Economies*: an ecosystem of just and sustainable economies where we prioritize people and the planet over endless profit and growth.

But can an investment advising practice be anti capitalist? We believe that it can be. Here’s how:

Our commitment to being an anticapitalist investment advising firm is a grounding anchor. It’s a beacon that we shine to call in aligned collaborators and partners in doing this work of shifting investments into the Solidarity Economy.

Chordata Capital is housed at Natural Investments. Natural Investments is the Registered Investment Advisor registered with the Securities and Exchange Commission. Natural Investments transitioned ownership from six human owners to a perpetual purpose trust (PPT) supervised by a seven-member Trust Stewardship Committee comprised of our advisors and staff. Natural Investments made this change to ensure that the firm, in perpetuity, stays committed to building a more just, equitable, and regenerative world.

*Solidarity Economy – Growing out of social movements in Latin America and the Global South, the solidarity economy provides real alternatives to capitalism, where communities govern themselves through participatory democracy, cooperative and public ownership, and a culture of solidarity and respect for the earth.