Shareholder Activism and Cross-Class Organizing at the Movement Finance Forum

By Kate Poole and Tiffany Brown

In early June, Kate attended the Movement Finance Forum along with a group of Chordata’s investors. Movement Finance Forum (MFF) was a 4-day convening conceived and organized by Center for Economic Democracy (CED). In 2022 CED published a paper on Social Movement Investing, positing that in order to truly build power, the work we’re doing in movement-aligned finance must be in deep coordinated relationship with organizing and movements for justice. As they sought to put this theory into action, CED was faced with the question: “How do we deepen coordination between movements fighting for justice and people in finance who have access to capital and technical expertise?” They call this capital strategies work, and use the framework of divest, contest, invest to describe different key levers that we need to coordinate.

The Movement Finance Forum grew out of that vision. CED convened nine different networks, bringing together a multiracial, cross-class, and multi-sector group of 140 people. The goal was to build relationships and strategize together in order to develop a shared approach to capital strategies that reflects movement values of wealth redistribution, repair, and power-building.

a session during the Forum – image by Anj Photographer

Let’s be real: It’s a hard time to think expansively about capital strategies, given escalating violence, federal funding being cut, and foundations pulling back. Despite these challenges, the Forum’s leadership brought deep clarity that we need to push much harder to leverage private capital in support of organizing. It was powerful to be invited into this call to action, and to grapple with it together.

There are two major themes we’re reflecting on coming out of the Forum.

The first is the role of “contest” in the divest, contest, invest strategies: How can we contest for power through shareholder activism, and what might Chordata’s role be in that?

Secondly, we’re reflecting on how to show up well as funders and investors to cross-class organizing spaces like the MFF.

the fabulous Chordata crew at the Forum!!!

Lessons about Contesting for Power through Shareholder Activism

Chordata has long been involved in solidarity economy investing, but we haven’t previously engaged in shareholder advocacy or divestment efforts targeting specific corporations. In the past, we have seen shareholder advocacy as largely something advisors did to keep making money off of investing in corporations while paying lip service to racial and economic justice. We’ve generally held the belief that there aren’t “good corporations” and “bad corporations”, but that all corporations are structurally harmful to communities and the environment. So, rather than engaging corporations directly, we’ve focused on divesting from the stock market and reinvesting in community-controlled projects that align with racial and economic justice values. That’s our bread and butter.

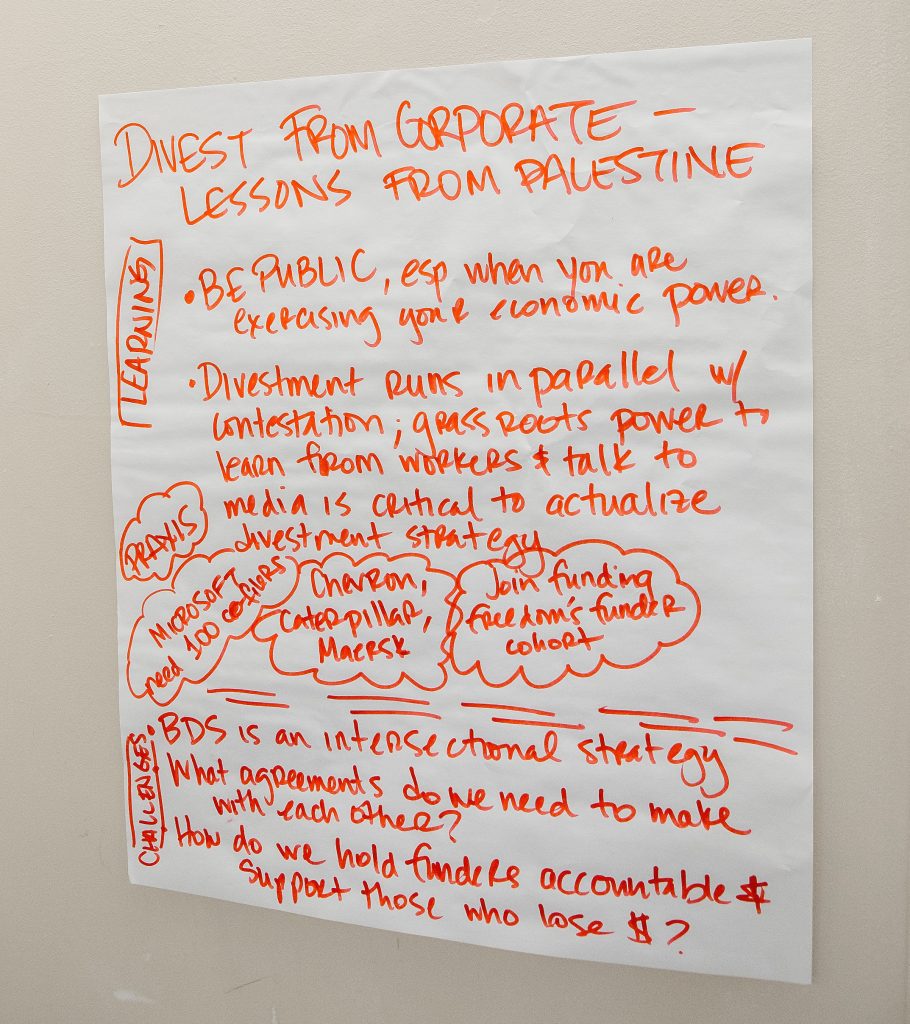

flipchart notes on lessons from Palestine Divestment – image by Anj Photographer

However, over the past two years our thinking has begun to evolve, particularly because of the divestment organizing we are seeing in solidarity with Palestine. The BDS movement (Boycott, Divestment and Sanctions) has opened our eyes to the potential of shareholder advocacy when it is truly movement-led. The organizations and firms that have worked to follow BDS calls and implement AFSC’s screens are responding directly to calls from solidarity movements, and are taking real risks that could impact their businesses and careers. We haven’t seen a movement-led divestment campaign making real material impact since the Standing Rock divestment organizing and divestment from private prisons.

Chordata may have a role to play: Though we divest our clients fully from the stock market, many of our clients have other points of leverage inside the system. Some of our clients hold only a portion of their assets with us, are part of family trusts or foundations, or are tied to institutions where divestment isn’t straightforward. In those situations, we’re excited about the potential of incorporating shareholder advocacy as a meaningful addition to the work we do with our clients. Shareholder advocacy can take individual processes around divestment and make them more collective, and do so in direct support of movements. It can also provide our community of investors with more tools to be active allies to movement leaders.

a workshop session at the Forum – image by Anj Photographer

Shareholder advocacy can powerfully flank worker-led campaigns inside of corporations. The Forum brought us into contact with movement leaders who are deliberately choosing to resource shareholder advocacy work, and with campaigns that are using those tools in exciting ways! One inspiring example is a Palestine-solidarity campaign targeting Microsoft. The campaign is promising: it originated with worker-led organizing from within the company, and focuses on holding Microsoft accountable for how its technology is being used in ways that violate human rights. It is a potentially winnable campaign! The workers have been able to connect with established shareholder activist groups who can then flank their work.

Shareholder advocacy campaigns can lay the groundwork for future legal fights against corporations. We learned about campaigns targeting Amazon run by groups like Interfaith Center on Corporate Responsibility (ICCR) and Majority Action. These groups have been in the game for a long time, and they are now in conversation with newer, movement-led efforts, including Amazon worker organizing. These shareholder advocacy groups aren’t likely to succeed against places like Amazon where Jeff Bezos owns the overwhelming majority of shares. However, shareholder proposals play an important role in laying the groundwork for future lawsuits against these corporations, because documentation of attempts to engage them around workers rights or human rights can be critical in these court battles. Even if the shareholder advocacy campaigns don’t win, they can set people up for these legal battles ahead.

We think Chordata’s investors are going to be seeing more shareholder activism opportunities from us in the future!

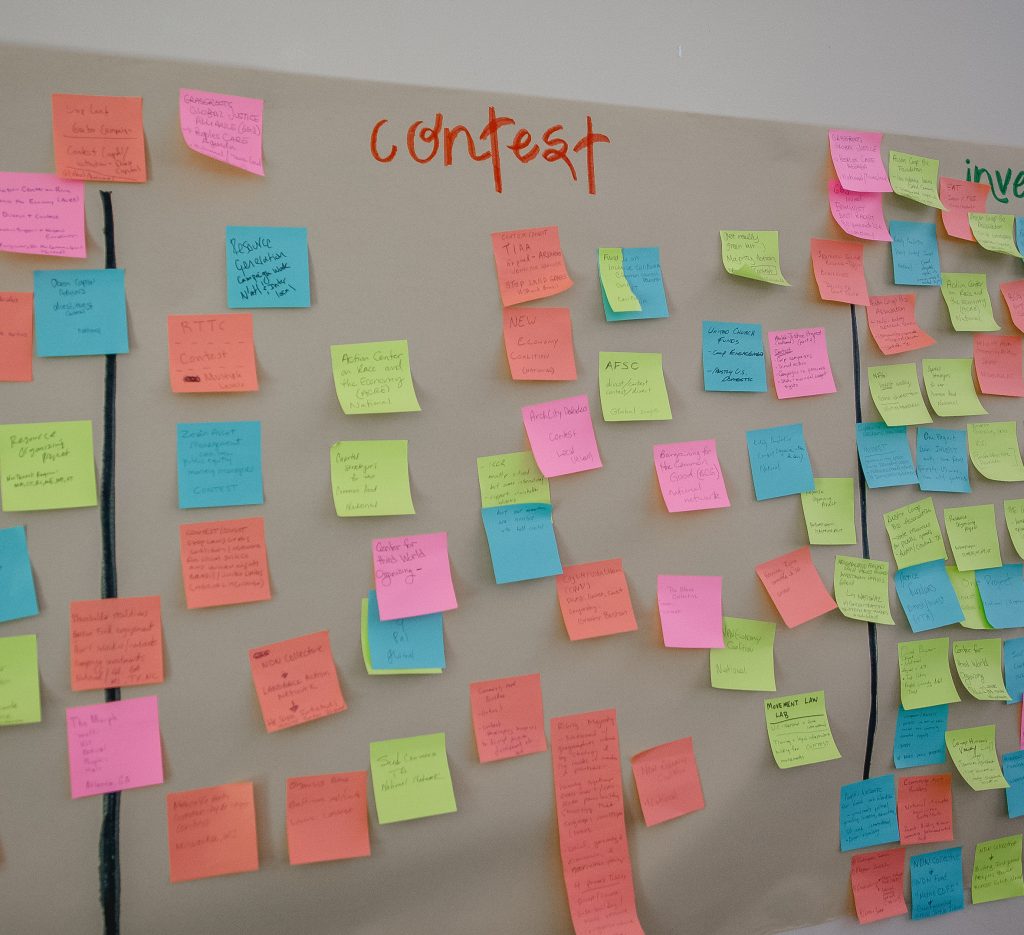

a brainstorm about contest strategies via post-it note – image by Anj Photographer

Lessons for funders and investors about cross-class organizing

The Forum brought movement leaders together with leaders in movement-aligned finance for the sake of deepening strategy and growing our capacity for coordination. As a group, we were working across class and navigating big differentials in access to capital. Afterwards, we (Tiffany, Kate, and the Chordata investor participants) debriefed the convening through the lens of cross-class organizing, and reflected on our ongoing learnings about how to show up well in cross-class spaces as movement-aligned investors.

Inside the networks present at the Forum, we all bring different gifts and resources to the table, and what unites us is a radical spirit. When coming together across class and power, it is hard to remove the polarizing relationship that is stoked by profound inequality in our country and world. We are asking ourselves: what is needed from committed, movement-aligned funders and donors in order to set a table together where we can count on everyone bringing what we have to help build the Solidarity Economy? Here are some of our reflections and questions:

a workshop session – image by Anj Photographer

It takes time to build relationships and trust. As anyone who’s ever participated in a coalition knows, it’s impossible to bring together diverse stakeholders and get things done without some basis of trust. And so, at the beginning stages of a huge cross-class effort like the Movement Finance Forum, building relationships and establishing trust is a primary goal. There was good groundwork laid in this area, and many relationships were created as a result of the convening.

Many of us attending the forum have known each other for a long time, and have built significant trust prior to the convening. At the same time, the Forum was intentionally broadening the conversation to include more people from our organizations and networks. This meant a lot of new relationships. We left wondering: Is there a way to build together that can assume a certain level of inherent trust in each network who has been invited? What pre-work could we and others could have done to build that trust before we got into the room together?

eating together – image by Anj Photographer

Redistributing wealth early in working together can help build trust. One of the key lessons we learned in founding Chordata is that in order to share power across class we need to share resources. If you’re a person or an institution with access to capital attempting to build trust across class, it’s crucial to engage in wealth redistribution or resource sharing. That resource sharing can be a foundation upon which you can build trust with each other. This is part of the DNA of our business, and a core value we hold dear.

We have been in the practice of wealth redistribution from our inception – between us as cross-class business partners, inside of our cohorts and with the practitioners who’ve helped shape those programs, and we are now looking to the Forum to help us think bigger about what this looks like as a true expression of what’s possible across class, race and power. Doing this across 9 networks and 140 people is considerably more complex than inside Chordata’s business model, and we want to meet this challenge and figure out what doing this well looks like along with the rest of the Forum participants.

It’s important to make pre-existing resource flows and collaborations visible. The Forum brought together a diverse set of networks, and people didn’t always know what others were already working on or how resources were moving currently. At times this led to assumptions and mistrust. For the sake of building a stronger foundation of trust, it may have been useful to map how resources were flowing and who is already in relationship around the work– because there were a lot of pre-existing relationships, and a lot of money moving already in powerful ways. This may have helped people relate to each other more as organizers and fellow members of the ecosystem, and serve as an example of the kind of financial activism on the investor side which could inform a shared strategy. How might we support this to happen in future convenings?

Kate studies post it notes during a session – image by Anj Photographer

As investors and funders, we need to build our muscle to sit with awkward and uncomfortable experiences. As a society, we are rarely in deep cross-class collaboration, and so there are going to be things that feel awkward or challenging. As people and/or institutions with power and privilege, we need to build the muscle of relating to others as people, while also holding the very real power differential that shapes our material realities. As investors, it’s important to stay present and notice what’s being activated in ourselves and in our bodies. We need to stay grounded in the fact that often, whatever is happening in a cross-class group is not personal, but rather a result of the larger political reality that we exist in. And, we need to take the appropriate level of accountability when we have created or contributed to dynamics that diminish or break trust. Engaging in our own ongoing healing work is critical so that we are all well positioned to build trust across class, race, and power. Affinity spaces like Resource Generation and Solidaire can help us build that muscle, as well as somatic and spiritual practices to keep ourselves grounded and self-aware.

Here are some resources we have found helpful for doing this inner work:

forum participants – image by Anj Photographer

Opportunities for action!

The Chordata crew that attended the Forum is exploring how we can support our larger community in understanding how divest, contest and invest levers work, possibly through mobilizing resources and organizing together.

We want to lift up some of the amazing and powerful projects and campaigns that we connected with at the Forum! We hope you’ll take a moment to learn more and consider supporting their work:

- There are several shareholder advocacy campaigns people can plug into, such as the ICCR-led Amazon shareholder advocacy work targeting Amazon, and Racial Justice Investing’s campaign to organize one hundred Microsoft shareholders to file a resolution demanding transparency from Microsoft about the use of its products in Israel’s illegal apartheid regime and war in Gaza. Or Stop Land Grabs, which is targeting TIAA. TIAA has pivoted into land as an investing strategy and is rapidly acquiring farmland in both the South of the US and the global south, particularly in Brazil.

Harvard students protesting Harvard’s role in land grabs – image from www.stoplandgrabs.org

- Divesting for Palestine: The next set of office hours for the MoveMoney4Freedom.org are now scheduled – RSVP here! MoveMoney4Freedom.org is a new website that provides accessible resources to support you and your community in divesting from genocide, apartheid and occupation, and moving money towards collective freedom. With questions, please contact info@movemoney4freedom.org. The next office hours are scheduled for Tuesday, August 12th, 2025 from 3-4 PM ET.

a student encampment demanding divestment for Palestine – image from www.movemoneyforfreedom.org

- This one isn’t a specific campaign, but an important action: The Forum emphasized the fact that organizations often have fees tied to accepting investments from investors. At Chordata, we’d like to start inviting our clients to consider covering those fees with grants, in support of the investment’s long term health. We encourage any investors to proactively cover these kinds of fees when making investments.

- Action St. Louis and ArchCity Defenders, two Black-led racial justice organizations in St. Louis, have come together to establish the Northside Movement Center. The 36,000-square-foot center will open in early 2026 in North St. Louis, a historically Black community that has suffered decades of systematic disinvestment. In addition to housing the multifaceted advocacy and organizing work of these two organizations, it will serve as a community center, convening and coworking space, and resiliency hub. If you are interested in learning more or supporting, please contact executive directors Blake Strode (bstrode@archcitydefenders.org) or Kayla Reed (kayla@actionstl.org).

an illustration of the future Northside Movement Center – image by Trivers

- Boston Neighborhood Community Land Trust (BNCLT) builds community power, neighborhood stability, and an alternative model for social housing by taking properties off the speculative market. BNCLT is one of few organizations that focus on acquiring smaller, scattered-site buildings – properties that are most prone to purchase by speculative buyers, resulting in the displacement of BIPOC, low and extremely low-income families. BNCLT is currently seeking to replace a $3 Million short-term loan that allowed the organization to purchase 5 buildings (17 units), which are now community-controlled and permanently affordable rental units. We invite solidarity investors to make a 0-2% interest, 10-year term investment in BNCLT’s Loan Pilot – a needed alternative to existing high-debt lending options. More info here!

Boston row houses – image from www.bnclt.org