In 2024 Chordata invested in Communities In Partnership (CIP) after being connected to the organization through Lina, a client local to Durham NC. In March, Tiffany and Lina spent two days visiting CIP’s many projects in East Durham and getting to know their dedicated leadership. Our team member Sarah sat down with Tiffany and Lina to debrief their visit.

CIP is a Black women led, predominantly Black women founded, community accountability organization that is nationally recognized for its work addressing all five social determinants of health. CIP supports interconnected programs addressing food sovereignty, entrepreneurship and workforce development, affordable housing, and leadership development. CIP envisions East Durham and the surrounding area as a vibrant place where all residents have an exceptional quality of life with the economic and political power to impact decision making that affects their community. If you’re interested in supporting CIP’s work, please do so here!

Sarah: Lina, how did you first hear about Communities in Partnership?

Lina: I heard about Communities in Partnership in 2018 through the Triangle Community Foundation. I started giving a monthly donation but I hadn’t met any of the team there. In early 2019, through alternative education circles in Durham, I met Valine Zeigler who’s the founder and director of Empowered Minds Academy, an incredible Montessori and self-directed learning school in Durham. I didn’t know at the time but Valine was connected personally and professionally with CIP.

After I’d been supporting Empowered Minds for a couple of years, the building they were in came up for sale and they were trying to figure out if it would be possible to buy it. I wanted to be supportive of EMA through whatever happened. CIP was interested in buying the building, because part of their vision is around Black ownership of business and property in downtown Durham, which is rapidly gentrifying and becoming unaffordable.

So we worked together, and I ended up donating the biggest gift that I’ve ever given to help, and CIP actually bought the building! Now CIP owns the building and Empowered Minds is the first Black-owned Black-led business that’s occupying that space, with the idea that ownership will remain in the community’s hands.

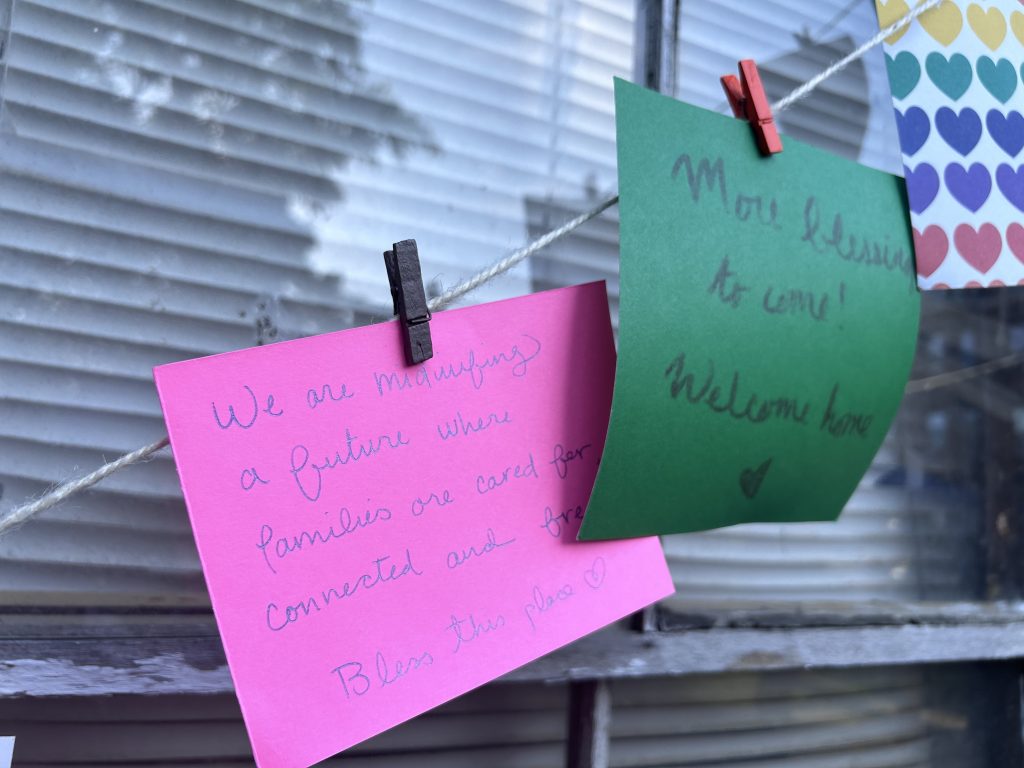

The beautiful building that houses Empowered Minds Academy

I saw a lot of natural alignment between what CIP is doing and what Chordata invests in, so I connected them with Tiffany and Kate, and that first conversation has evolved now into this current investment in CIP.

Sarah: Tiffany, how was your trip to Durham?

Tiffany: It was such a great trip. We first heard about CIP from Lina, then learned that they are a part of Equitable Food Oriented Development, a project our friend and colleague Anthony Chang supports. I already knew CIP’s work was amazing, but seeing the work and meeting their leaders was very impactful.

I was really moved by the story of how Communities in Partnership was created. CIP started in 2011 after there was a shooting in the East Durham neighborhood, and the community was frustrated by an inadequate and uninformed response from city officials. Community members started gathering for the sake of building relationships and asking, “What’s going on? How do we address the violence that’s happening in our neighborhood?” They were mostly parents, so this was really high stakes. The first arm of their work was around food justice, and they started a food cooperative. Now – flash forward – they have a very strategic approach to addressing interlocking systems of oppression, aimed at transforming their neighborhoods.

Inside the East Durham Market. Pictured is Lina, Cassie (staff member at CIP), and Justin (Tiffany’s partner).

During our tour I got to see the food cooperative’s Impact Hub, where they give out food boxes. They talked about lines down the street of people coming to get food boxes. Then I got to see the East Durham community market, which is a grocery store that can help meet basic food needs of community members.

There’s another arm of CIP’s work focused on entrepreneurship that supports the Culinary Femme Collective, a group of femmes of color who all have food businesses and share a commissary, and are getting their food wares out in front of people, including at the East Durham market. Oh my God – they had the best crackers!! Part of our investment is going toward supporting the Collective’s entrepreneurial ventures.

Delicious crackers created by a member of the Culinary Femme Collective! The Collective works to advance food businesses owned by femmes of color dedicated to creating a more equitable and just local food economy in Durham.

We also saw the Empowered Minds Academy building that CIP purchased. The pedagogy is amazing – the kids really lead and it’s predominantly Black and Brown children. CIP is also working with a developer who’s building housing, including a modern day boarding house, and the Culinary Femme Collective is going to have a cafe there to sell their wares. Everything we saw was connected and part of a bigger plan.

Chordata’s investment is primarily in support of acquisitions of real estate, because gentrification is actively pushing Black and Brown people out of their community. Their neighborhood is only half a mile from downtown Durham and in order to keep community members in place they’re purchasing buildings and offering affordable rent to community members.

Cassie, Tiffany & Lina outside the East Durham Market

A lot of the folks involved in the project from early on have taken on major leadership roles. Camryn Smith, who is CIP’s Executive Director, and her husband Ernest Smith are both trained in Community-Based Asset Development. They intentionally moved into the East Durham community upon returning from mission work in Eastern Europe, and Ernest earned his law degree late career to be able to address key needs voiced by the community. DeDreana Freeman is a mother, a nonprofit leader, and has been a City Councilwoman since 2017. Aliyah Abdur-Rahman, a founding member and leader of the CIP Innovation portfolio, has built a visionary collective strategy across multiple Black-led and Black-accountable organizations in the East Durham community. This is what organizing looks like!

A living library exhibit in the Impact Hub, where CIP runs their food program. The Impact Hub also has drumming lessons, step classes, and other community programming.

It was a pretty emotional trip. Throughout my travels around the country I’m seeing a repeated theme of systemic disinvestment. What I saw reminded me of my visit to West Jackson, where there were potholes in the street so big that you couldn’t drive straight. In East Durham, there were dirt roads, and you’re just half a mile from the city. You would see a house with a $1M value that is part of gentrification, right next to a house that looked like it was condemned, but it was really being rented out by a slumlord who wasn’t investing any money in it. A lot of those houses were going for something like $10,000 just 15 years ago. The racist red lining in East Durham meant that nobody in the community was able to get a loan to buy houses, and purchasers would need to pay in cash. Gentrifiers were just buying up the houses with hopes of making a big return because they’re so close to Duke and downtown.

That’s where CIP’s strategy to buy real estate comes in. One of CIP’s recently purchased properties we visited was four duplexes. They are in the process of fixing these up and making them nice for people. They’ll then offer them to the community at prices that people can afford. It’s really powerful work.

Community In Partnership’s Impact Hub

Sarah: Lina, what do you love about CIP?

Lina: I love the enormity of the heart and vision and the real commitment to the people who are in Durham. They have this real clarity that everyone deserves to have enough to eat, a safe place to live, time to pursue whatever it is that they are passionate about, and that everyone deserves basic human dignity.

For CIP, it’s not only about survival and people being able to continue to afford to live in Durham, but beyond that, they believe that people also need to heal from the harm that has persisted for a long time. They have the vision, and also the dedication and determination to figure out how to make that real.

Tiffany, Cassie, Lina inside the Impact Hub, with food boxes in the background

Sarah: Tiffany, how was it for you to collaborate with Lina on this?

Tiffany: This was the first time we have worked alongside a client in this way. Lina is committed to racial justice and economic justice and made the bold move to support the purchase of this school building. She saw the values alignment and brought CIP to our attention. As we started meeting with CIP, we realized this was a project that our other clients would be excited about. I love that we got to lean into a model of collective action within the Chordata community by supporting our client’s badass contributions, and that it led to an opportunity for the whole community to invest.

Sarah: Lina, is there anything else you want to share with the Chordata community?

Lina: I just want to convey how good it feels to me to be working with Kate and Tiffany. Especially with all the craziness of the world and the stock market. I have money held in trust for my benefit over which I have very little control. It is invested in the stock market because the trustees insist it is their fiduciary responsibility and that anything else would be irresponsible. Those investments have nosedived in the past weeks. And my personal money that I have been able to invest with Chordata, it’s invested in places like CIP, like East Bay PREC, and all the other places Kate and Tiffany have put it. All of that money is, for now, holding steady. AND, even if the scenario was flipped, I would still feel good about my Chordata investments because my money is not just at the whims of this crazy stock market machine.

My money is not just extracting with the point of benefiting only me, it’s really going to work in ways that are building something amazing. It’s experimenting with building a new world instead of experimenting with extraction and suffering. It’s so powerful for me to be part of the Chordata community in that way. And I feel so grateful to the other Chordata clients who have thrown in with me here in Durham!

We hope you’ll support CIP’s work! Learn how to do so here.